"Are they real?" That's the question people usually ask when they hear for the first time of the "Citigroup Plutonomy Memos." The sad truth is: Yes, they are real, and instead of being discussed on mainstream media outlets all over America and beyond, Citigroup was surprisingly successful so far in suppressing these memos, using their lawyers to issue takedown-notices whenever these memos were being made available for download on the internet.

So what are we talking about? In 2005 and 2006, several analysts at Citigroup took a very, very close look at the economic inequalities within the USA and other countries and wrote two memos which were addressed to their very wealthy customers. If there is one group of people who need to know the truth about what is really going on within the society and the economy, minus the propaganda, then it's businesspeople who have a lot of money to invest, and who want to invest wisely.

So Citigroup did their duty and published two explosive memos, which should have become mainstream news, but eventually did not. The first memo is dated October 16, 2005 (35 pages) and is titled: "Plutonomy: Buying Luxury, Explaining Global Imbalances."

Screenshot:

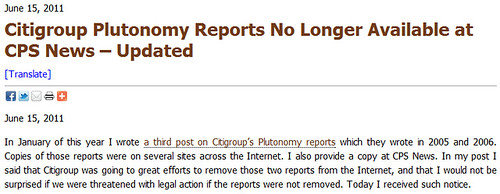

Screenshot:

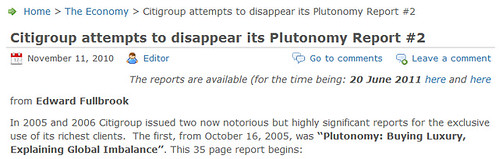

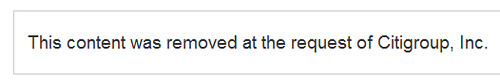

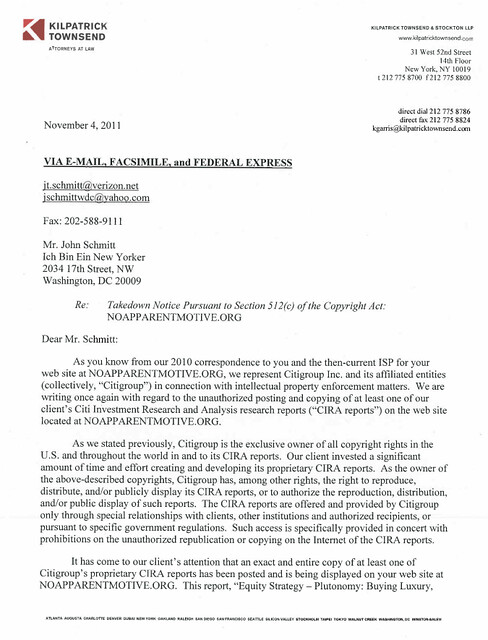

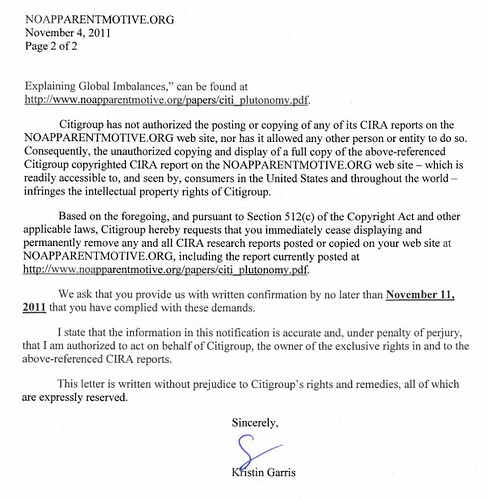

A few years ago, two copies of these memos were leaked and were published on the internet. Usually one should think that once such important documents are in the "public domain", nothing should stop them any more from being distributed and being openly discussed. However, the lawyers of Citigroup, Kilpatrick Townsend & Stockton LLC, work hard to prevent exactly that from happening. Examples of their activities can be found all over the internet.

Examples of the reports deleted from "scribd.com" after Citigroup demanded their takedown (here and here):

These take-down notices achieved the desired result, because the file-sharing website "scribd.com" now even takes down the reports "automatically", once somebody attempts to upload them again:

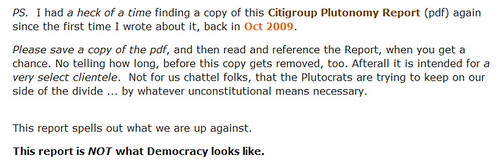

The blog "No Apparent Motive" reported that they received a take-down letter from Citigroup's lawyers after they posted a download link to a copy of one of the memos:

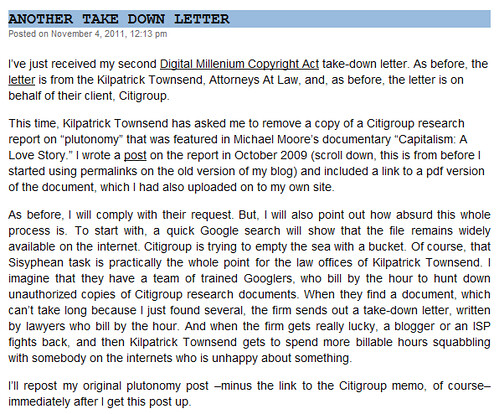

They also published the take-down letter which they received on November 4, 2011 from law firm Kilpatrick Townsend & Stockton LLC:

Therefore it is apparent that Citigroup is paranoid that these memos by their analysts are being widely distributed. It is not necessary to include a download link in this post, as the memos are pretty easy to find with a simple google search.

However, Citigroup seems to have been successful in preventing a wider discussion about the memos, due to their legal actions. This needs to stop, as every American and every citizen in the western world needs to know what people like the analysts of Citigroup really think about the inequalities which exist within the societies, how the rich should preserve their domination, and what possible "backlash" can be expected - and what the consequences are of living in a "plutonomy."

At the beginning of the first memo "Plutonomy: Buying Luxury, Explaining Global Imbalances", the analysts introduce the subject:

Little of this note should tally with conventional thinking. Indeed, traditional thinking is likely to have issues with most of it. We will posit that:

1) the world is dividing into two blocs - the plutonomies, where economic growth is powered by and largely consumed by the wealthy few, and the rest.

Plutonomies have occurred before in sixteenth century Spain, in seventeenth century Holland, the Gilded Age and the Roaring Twenties in the U.S. What are the common drivers of Plutonomy?

Disruptive technology-driven productivity gains, creative financial innovation, capitalist- friendly cooperative governments, an international dimension of immigrants and overseas conquests invigorating wealth creation, the rule of law, and patenting inventions. Often these wealth waves involve great complexity, exploited best by the rich and educated of the time.

2) We project that the plutonomies (the U.S., UK, and Canada) will likely see even more income inequality, disproportionately feeding off a further rise in the profit share in their economies, capitalist-friendly governments, more technology-driven productivity, and globalization.

Citigroup explains how the "non-rich" consumers become increasingly irrelevant within the "plutonomies":

4) In a plutonomy there is no such animal as “the U.S. consumer” or “the UK consumer”, or indeed the “Russian consumer”. There are rich consumers, few in

number, but disproportionate in the gigantic slice of income and consumption they take.

There are the rest, the “non-rich”, the multitudinous many, but only accounting for surprisingly small bites of the national pie. Consensus analyses that do not tease out the profound impact of the plutonomy on spending power, debt loads, savings rates (and hence current account deficits), oil price impacts etc, i.e., focus on the “average”consumer are flawed from the start. It is easy to drown in a lake with an average depth of 4 feet, if one steps into its deeper extremes. Since consumption accounts for 65% of the world economy, and consumer staples and discretionary sectors for 19.8% of the MSCI AC World Index, understanding how the plutonomy impacts consumption is key for equity market participants.

The analysts of Citigroup then invent a new term - "The New Managerial Aristocracy":

THE UNITED STATES PLUTONOMY - THE GILDED AGE, THE ROARING TWENTIES, AND THE NEW MANAGERIAL ARISTOCRACY

Let’s dive into some of the details. As Figure 1 shows the top 1% of households in the U.S., (about 1 million households) accounted for about 20% of overall U.S. income in 2000, slightly smaller than the share of income of the bottom 60% of households put together. That’s about 1 million households compared with 60 million households, both with similar slices of the income pie!

Clearly, the analysis of the top 1% of U.S. households is paramount. The usual analysis of the “average” U.S. consumer is flawed from the start. To continue with the U.S., the top 1% of households also account for 33% of net worth, greater than the bottom 90% of households put together. It gets better(or worse, depending on your political stripe) - the top 1% of households account for 40% of financial net worth, more than the bottom 95% of households put together.

This is data for 2000, from the Survey of Consumer Finances (and adjusted by academic Edward Wolff). Since 2000 was the peak year in equities, and the top 1% of households have a lot more equities in their net worth than the rest of the population who tend to have more real estate, these data might exaggerate the U.S. plutonomy a wee bit.

Was the U.S. always a plutonomy - powered by the wealthy, who aggrandized larger chunks of the economy to themselves? Not really.

Citigroup also makes clear what the CEO's of the world need: More money.

Quote:

To me, free elections do not seem to be compatible with a plutonomy. But the 1% seem to try to take care of this problem, as the USA has witnessed sophisticated examples of election fraud since 2000, and the country is at the same time drowning in propaganda, for example by the Koch-Brothers propaganda machine, who are gearing up for 2012, the "the mother of all wars", because "we have Saddam Hussein", as Charles Koch casually remarked at their secret summer seminar in 2011:

While I researched the subject, I discovered that there also exists an additional third, shorter Citigroup memo, dated September 29, 2006, which is being mentioned here.

Society and governments need to be amenable to disproportionately allow/encourage the few to retain that fatter profit share. The Managerial Aristocracy, like in the Gilded Age, the Roaring Twenties, and the thriving nineties, needs to commandeer a vast chunk of that rising profit share, either through capital income, or simply paying itself a lot. We think that despite the post-bubble angst against celebrity CEOs, the trend of cost-cutting balance sheet-improving CEOs might just give way to risk-seeking CEOs, re-leveraging, going for growth and expecting disproportionate compensation for it. It sounds quite unlikely, but that’s why we think it is quite possible. Meanwhile Private Equity and LBO funds are filling the risk-seeking and re-leveraging void, expecting and realizing disproportionate remuneration for their skills.

But does placing so much money in so few hands also pose risks? Maybe the 99% of the population, or let it be 90-95%, it does not matter, will be unhappy about being ruled by the super rich?

Fortunately for the investors, the analysts at Citigroup also considered these points and started to think about the plebs who, as history shows, have a tendency to be unruly, if poor. So the analysts started to think about "losers", as they call them, or the people who could need a bath, as Newt Gingrich would call it. The Citigroup analysts basically predicted the OWS-movement.

In considering these aspects, the analysts also discovered that there is a terrifying factor to consider - that the poor don't have much economic power, but that they "have equal voting power with the rich."

Quote:

IS THERE A BACKLASH BUILDING?

Plutonomy, we suspect is elastic. Concentration of wealth and spending in the hands of a few, probably has its limits. What might cause the elastic to snap back? We can see a number of potential challenges to plutonomy.

The first, and probably most potent, is through a labor backlash. Outsourcing,

offshoring or insourcing of cheap labor is done to undercut current labor costs. Those being undercut are losers in the short term. While there is evidence that this is positive for the average worker (for example Ottaviano and Peri) it is also clear that high-cost substitutable labor loses.

Low-end developed market labor might not have much economic power, but it does have equal voting power with the rich. We see plenty of examples of the outsourcing or offshoring of labor being attacked as “unpatriotic” or plain unfair. This tends to lead to calls for protectionism to save the low-skilled domestic jobs being lost. This is a cause championed, generally, by left-wing politicians. At the other extreme, insourcing, or allowing mass immigration, which might price domestic workers out of jobs, leads to calls for anti-immigration policies, at worst championed by those on the far right.

To this end, the rise of the far right in a number of European countries, or calls (from the right) to slow down the accession of Turkey into the EU, and calls from the left to rebuild trade barriers and protect workers (the far left of Mr. Lafontaine, garnered 8.5% of the vote in the German election, fighting predominantly on this issue), are concerning signals. This is not something restricted to Europe. Sufficient numbers of politicians in other countries have championed slowing immigration or free trade (Ross Perot, Pauline Hanson etc.).

Then comes a key-part of the first "Plutonomy" memo: Plutonomy only works if the members of a society have the impression that they can still participate, despite the harsh inequalities, that they "can join it." The analysts use the term "robber-baron economies" and conclude that a "potential social backlash" is possible. Becoming a "Pluto-participant" is the "embodiement of the 'American Dream'" -and this dream should not die, otherwise the Plutocrats could be in real trouble. Quote:

A third threat comes from the potential social backlash. To use Rawls-ian analysis, the invisible hand stops working. Perhaps one reason that societies allow plutonomy, is because enough of the electorate believe they have a chance of becoming a Pluto-participant. Why kill it off, if you can join it? In a sense this is the embodiment of the “American dream”. But if voters feel they cannot participate, they are more likely to divide up the wealth pie, rather than aspire to being truly rich.

Could the plutonomies die because the dream is dead, because enough of society does not believe they can participate? The answer is of course yes. But we suspect this is a threat more clearly felt during recessions, and periods of falling wealth, than when average citizens feel that they are better off. There are signs around the world that society is unhappy with plutonomy - judging by how tight electoral races are.

But as yet, there seems little political fight being born out on this battleground.

A related threat comes from the backlash to “Robber-barron” economies. The

population at large might still endorse the concept of plutonomy but feel they have lost out to unfair rules. In a sense, this backlash has been epitomized by the media coverage and actual prosecution of high-profile ex-CEOs who presided over financial misappropriation. This “backlash” seems to be something that comes with bull markets and their subsequent collapse. To this end, the cleaning up of business practice, by high-profile champions of fair play, might actually prolong plutonomy.

The second memo, titled "Revisiting Plutonomy: The Rich Getting Richer" deals mainly with the consequences for investments which follow the analysis in the first memo. Quote:

There are, in our opinion, two issues for equity investors to consider. Firstly, if we are right, that plutonomy is to blame for many of the apparent conundrums that exist around the world, such as negative savings, current account deficits, no consumer recession despite high oil prices or weak consumer sentiment, then so long as the rich continue to get richer, the likelihood of these conundrums resolving themselves through traditionally disruptive means (currency collapses, consumer recessions etc) looks low. The first consequence for equity investors who worry about these issues, is that the risk premia they ascribe to equities to reflect these conundrums/worries, may be too high.

Secondly, if the rich are to keep getting richer, as we think they will do, then this has ongoing positive implications for the businesses selling to the rich. We have called these businesses “Plutonomy stocks”. We see three reasons to take another look at those plutonomy stocks.

Citigroup seems to be perfectly happy with the rule of the rich. They are also perfectly happy to suppress these explosive memos. What if Americans don't believe into the American Dream any more? What if the thoughts of OWS-protesters slip into the mainstream? (Fortunately, this is already happening). The rule of the 1% is not a conspiracy theory, it's a fact, as the Citigroup analysts explain in great detail. The citizens in the "Plutonomies" are expected to swallow this bitter pill. The Koch Brothers and others can buy politicians and make sure that they get their way, also thanks to the Koch-friend Clarence Thomas and his colleagues in the Supreme Court who made the "Citizens United" decision possible.

But don't forget:

You "have equal voting power with the rich."

While I researched the subject, I discovered that there also exists an additional third, shorter Citigroup memo, dated September 29, 2006, which is being mentioned here.

The summary on the first page of this memo, which another report for their super-wealthy investors, boldly presents "Plutonomy" not only as a fact, but a business great business opportunity:

The Global Investigator

The Plutonomy Symposium — Rising Tides

Lifting Yachts

➤ Time to re-commit to plutonomy stocks – Binge on Bling.

Equity multiples appear too low, the profit share of GDP is high and likely going higher, stocks look likely to beat housing, and we are bullish on equities. The Uber-rich, the plutonomists, are likely to see net worth-income ratios surge, driving luxury consumption.

Buy plutonomy stocks (list inside).

➤ Plutonomy stocks at a premium, but relative pricing power is key.

➤ Our Plutonomy Symposium take-aways.

The key challenge for corporates in this space is to maintain the mystique of prestige while trying to grow revenue and hit the mass-affluent market. Finding pure-plays on the plutonomy theme, however, is tricky.

➤ Plutonomy and the Great Conundrums of our age.

We think the balance sheets of the rich are in great shape, and are likely to continue to improve. Don’t be shocked if the savings rate worsens as equities do well.

➤ What could go wrong?

Beyond war, inflation, the end of the technology/productivity wave, and financial collapse, we think the most potent and short-term threat would be societies demanding a more ‘equitable’ share of wealth.

Yes, what could possibly "go wrong?" The "threat" exists that societies would be "demanding a more ‘equitable’ share of wealth."

Thank God that we have such splendid police forces whose members seem to be very happy to quash any unrest with batons, tear gas, pepper spray and a high degree of rough behaviour in order to keep the plutonomists happy!

Despite not having received widespread mainstream coverage, the Citigroup memos have been discussed in a handful TV-clips or documentaries.

When Bill Moyers "signed off" with his last broadcast in 2010, he extensively quoted from the Citigroup memos and explicitly warned that Plutocracy and Democracy "do not mix":

In addition, Michael Moore reported about the Citigroup plutonomy memos in his documentary "Capitalism - A Love Story":

Finally, I have a note for you-know-who:

17 U.S.C. § 107

Notwithstanding the provisions of sections 17 U.S.C. § 106 and 17 U.S.C. § 106A, the fair use of a copyrighted work, including such use by reproduction in copies or phonorecords or by any other means specified by that section, for purposes such as criticism, comment, news reporting, teaching (including multiple copies for classroom use), scholarship, or research, is not an infringement of copyright. In determining whether the use made of a work in any particular case is a fair use the factors to be considered shall include:

the purpose and character of the use, including whether such use is of a commercial nature or is for nonprofit educational purposes;

the nature of the copyrighted work;

the amount and substantiality of the portion used in relation to the copyrighted work as a whole; and

the effect of the use upon the potential market for or value of the copyrighted work.

The fact that a work is unpublished shall not itself bar a finding of fair use if such finding is made upon consideration of all the above factors.

We are not taking anything down, we take up the fight against the people who believe that they have the right to be the unelected leaders of the world.

+++

UPDATE:

Investigative journalist and blogger Lee Fang picks up the subject of the suppressed Citigroup-memos at his blog "The Second Alarm" and comments about the possible consequences of the pending SOPA/PROTECT IP-legislation for investigative blog journalism:

Clearly, this is a brazen abuse of copyright law to suppress legitimate journalism. The documents were already widely leaked, and the bloggers writing about them were doing so under conditions which I think most would consider “fair use.” The bareknuckle tactics by Citigroup’s attorneys show the power of the laws already on the books, like the DMCA, which allows copyright holders to demand that user-submitted content websites like Scribd and Blogspot.com remove copyrighted material. For one thing, its not even clear if the Plutonomy Memos constitute protected copyright material. I’m obviously not a lawyer, but its hard to see the expressive value of the memos. It’s a messed up situation, where just the threat of litigation has already chilled speech, but it could get much, much worse.

If SOPA/PROTECT-IP passes, then copyright holders like Citigroup will gain the ability to shut down entire websites without a court order, a power well beyond the DMCA and other digital copyright laws. That means independent blogs, media outlets, etc., will become targets for destruction when they publish allegedly copyrighted whistleblower documents and other leaked memos. Independent media will be delisted from search engines and their domains could be blocked. SOPA/PROTECT-IP is an assault on journalism (see this breakdown by Jessica Roy at Mediabistro), but the latest moves by Citigroup only reinforce the danger.

This week, the House will begin to mark-up the bill.

Back when I worked at ThinkProgress, I repeatedly broke stories using leaked memos and other internal documents from powerful corporations. Needless to say, ThinkProgress routinely posts and links to content that could arguably be considered copyrighted material or associated with “pirate” websites (like Wikileaks or the Piratebay). If SOPA/PROTECT-IP is signed into law, it’s not too extreme to suggest that even ThinkProgress or the blog’s advertisers could fall into the crosshairs of copyright trolls.

+++

UPDATE:

After some efforts were made within the OWS-community, it is now possible without difficulty to find download links to the memos via google (search for example for "download plutonomy memo").

No comments:

Post a Comment